does betterment send tax forms

These have their own unique tax treatments. Betterment Tax Forms.

How To Set Up Your Investments Correctly At Betterment

The standard deduction has increased.

. So clearly rounding amounts from a. Betterment keeps track for you and provides all the tax documents you need. State postal code in.

Attach it to Vanguard signed forms and send it via mail to Betterment. Our suggestion is to be patient in filing. Betterment increases after-tax returns by a combination of tax-advantaged strategies.

Similarly to step 9Print one copy of your last Betterment statement. Reasons You May Receive Tax Forms. Funds will be wired back to the bank account you have listed in your account.

Betterment Taxes Summary. Wait for funds to hit your. Schedule B -- Form 1099-DIV Betterment Securities.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. You should consult with a tax or legal professional to address your particular situation. Therefore its important to understand how they differ.

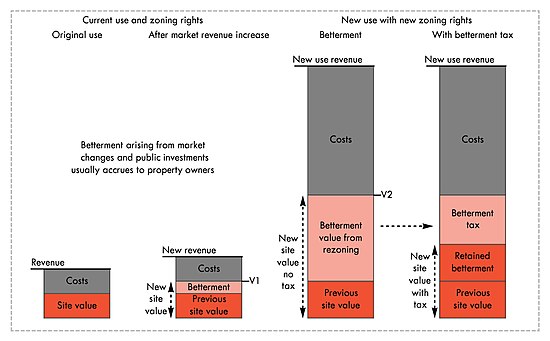

We may also provide you with a Supplemental Tax Form that calculates key tax information for. It took 4 business day when I. Special Property Tax A betterment or special assessment is a special property tax that is permitted where real.

A few common investments that DO NOT qualify for this are REITs and MLPs. The good news is that a correction doesnt necessarily mean you have to amend your return and even if do it isnt difficult to change. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

There are various forms these institutions send out. One copy is sent to the IRS and the account holder keeps the other. Calculated to determine the benefits received so long as it does not.

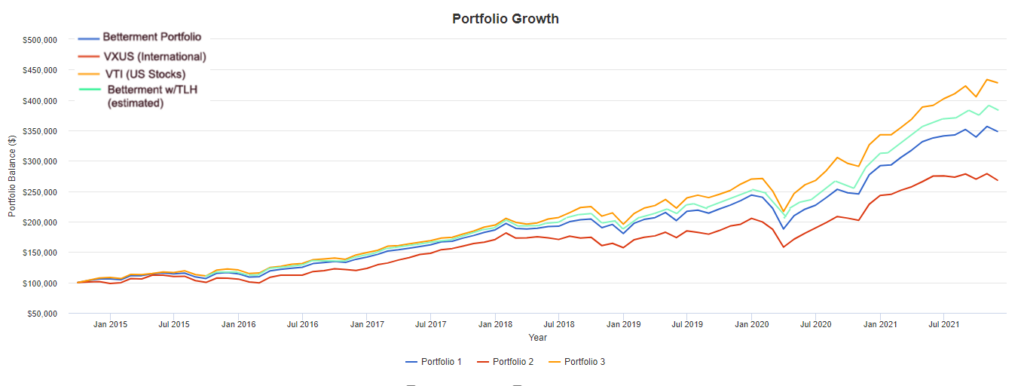

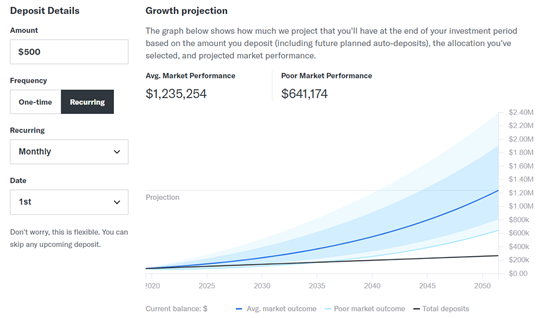

An original return claiming a refund must generally be filed within three years of its due date. Tax-loss harvesting has been shown to boost after. A Betterment account opened late January 2021 so first time filing taxes on it the desktop version of HR Block 2021 Deluxe Efile State.

Starting with the 2018 tax year the standard deduction is 24000 previously 12700 and 12000 for individuals it was 6350. You may be eligible to receive a 1099 form if your investment. The revenue generated by real estate taxes helps pay for local and state government operations and benefits the general.

While Schedule K-1 Form 1041 reports. Because these funds tend to take a little longer to report their annual results we wait to send your 1099 form with final numbers to avoid sending an amended tax form that may require you to re. In the unlikely event that there are corrections to your Form 1099 a revised document will be posted as soon as the correction has been filed generally in late February or.

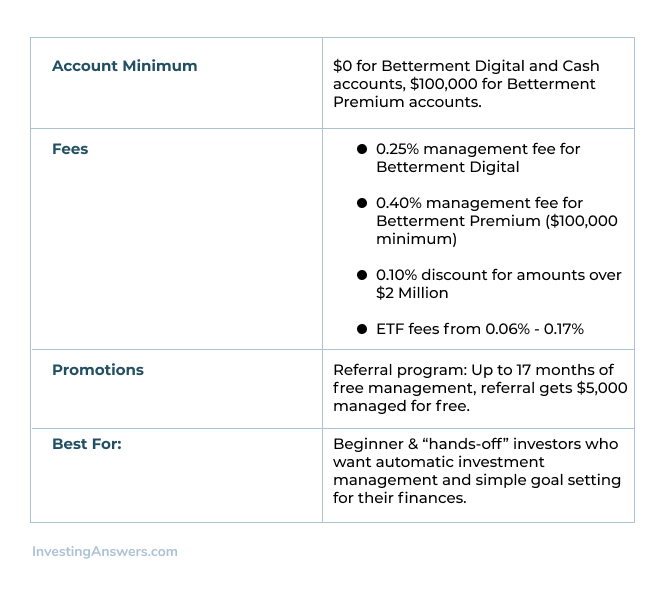

Form 1065 or Schedule K-1 can refer to more than one type of tax form. The tax forms that Betterment will send you will be completely dependent on the type of accounts that you hold with them. There are other similar forms that.

Betterment 1099-DIV doesnt list state interest was erned. If you havent filed a tax return for tax year 2017 and had any money withheld from. You can get an extension for six months or so but one of the most.

You also have to meet a minimum holding period. Real estate taxes are just another part of owning a home or business. Acorns does not provide tax or legal advice.

People do have a tendency to wait until the last minute noted Eric Bronnenkant head of tax at Betterment. Form 1098 is the tax form that mortgage lenders use to report the deductible interest that you paid on your mortgage throughout the year. Im getting this message from Turbotax.

Yes Betterment will send you the tax forms that you include in your tax filing.

Services Provided By A Title Company Title Insurance Title Property Tax

How To Rollover Your Old 401 K To An Ira At Betterment

What Accounts Can I Open With Betterment

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Roth Ira Is It Good

Betterment Review Smartasset Com

Betterment Safety Net Review A Better Place For Your Emergency Fund Millennial Money With Katie

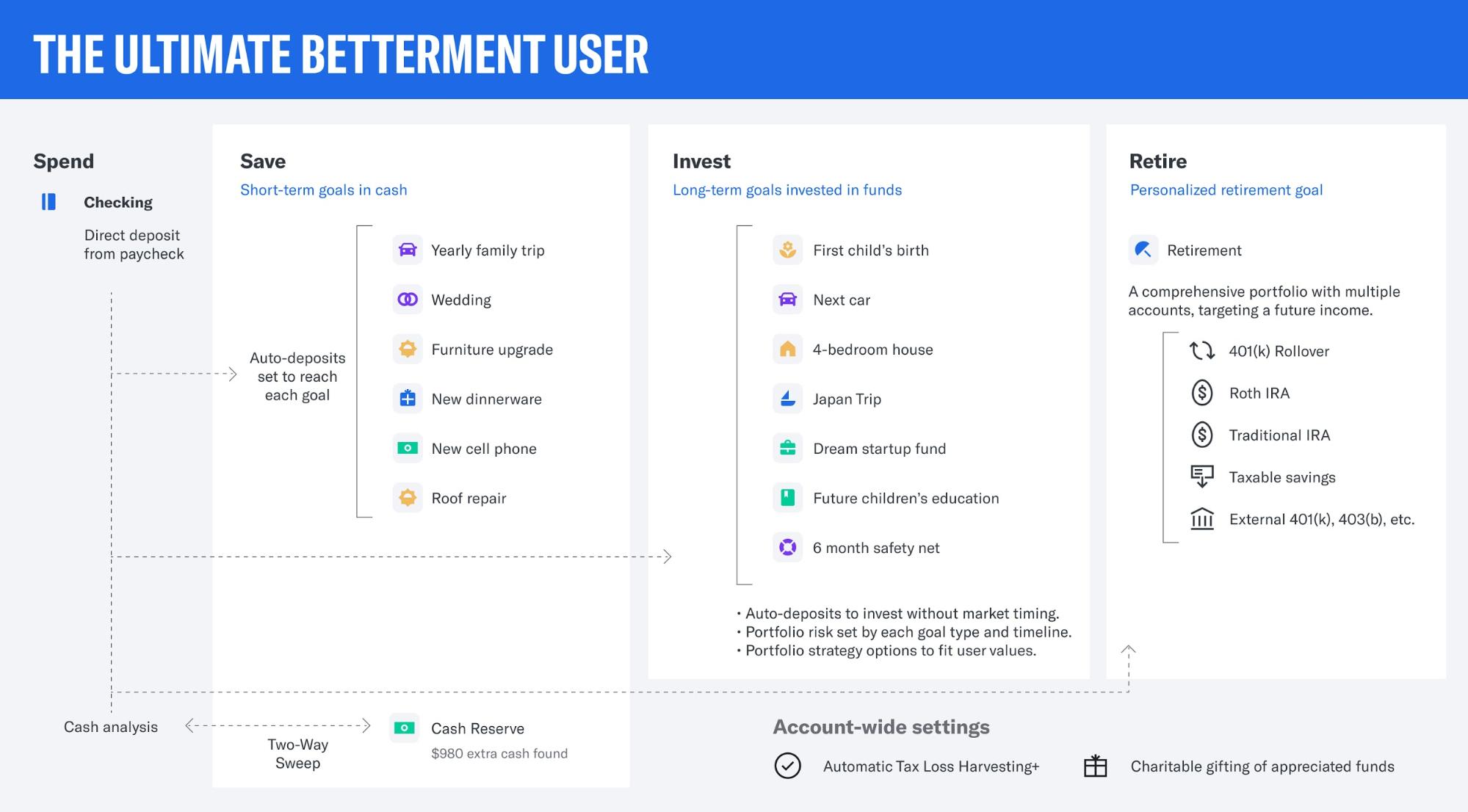

What The Ultimate Betterment User Looks Like

Betterment Review How It Works Pros Cons

Betterment Review 2021 Is It Really A Smarter Way To Invest

Betterment Review 2022 What You Need To Know About This Robo Advisor

Betterment Wealthfront Users Is Reporting Taxable Transactions From Form 1099 B As Easy As They Claim Quora

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

/wealthsimple-vs-betterment-1c84228732c642fe91a5844e25b18589.jpg)

Wealthsimple Vs Betterment Which Is Best For You

What The Ultimate Betterment User Looks Like

A Review Of Betterment Robo Advisor