how long does it take the irs to collect back taxes

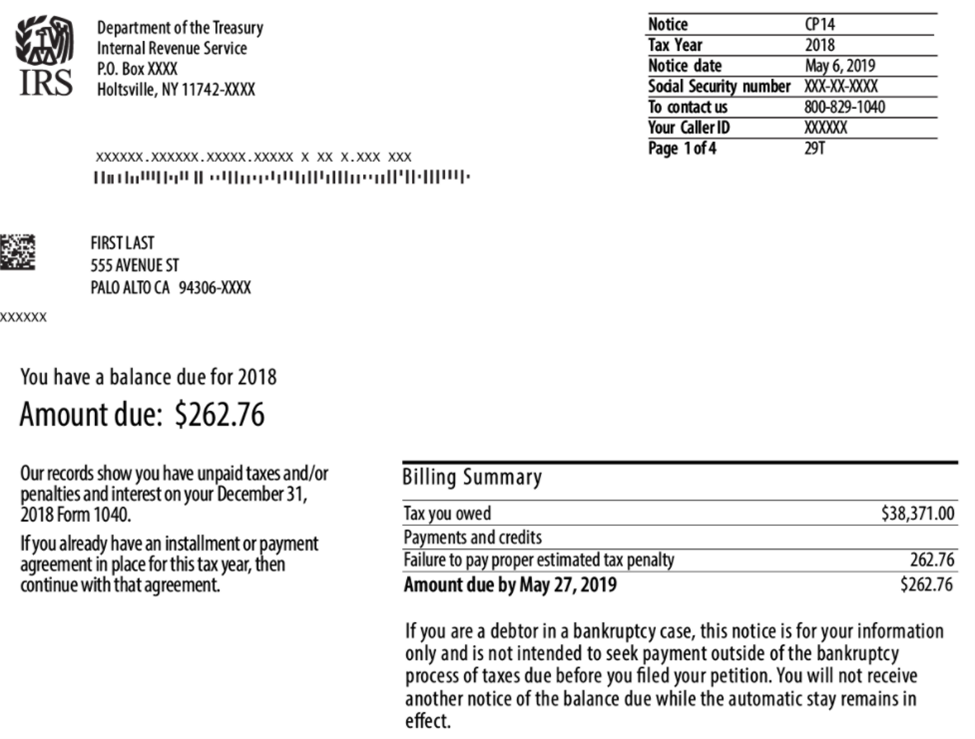

However if you requested a payment arrangement the IRS will send you a bill with all the information you need after they process your return. This is called the 10 Year.

How long does IRS have to collect back taxes.

. Just a very very long time. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years. If your return was accepted less.

If you paid personal income taxes in Massachusetts in 2021 and filed your 2021 Massachusetts tax return by October 17 2022 you are eligible to receive a 2022. Can the IRS go back more than 10 years. The IRS can also charge additional fees for doing business with foreign companies.

How Long Does The IRS Have To Collect Back Taxes. How long does it take IRS to collect payment once taxes have been filed online and accepted. You will have 90 days to file your past due tax return or file a petition in Tax Court.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. Statute of Limitations on IRS Debt Collection. After this 10-year period or statute of.

The direct debit will occur on or after the date you specified when you selected. After that the debt is wiped clean from its books and the IRS writes it off. This means that the IRS can attempt to collect your unpaid.

This is known as the statute of. Tax bills of less than 50000 take 4-6 months. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

If you do neither we will proceed with our proposed assessment. Whether the winner would choose an annuity or the reduced lump sum taxes would take a big bite out of the prize. If you have received notice.

However if you are getting notices from the IRS and you are wondering if they will ever go away the answer is yes. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. The Internal Revenue Service the IRS has ten years to collect any debt.

This means that the IRS cannot collect tax debts that are more. If you leave the country for a period of 6 months or more then the IRS has at least 6 months after you return to attempt to collect the debt. Assessment is not necessarily the.

This is true even if the statute of. This allows the IRS to contact the bank on your behalf to attempt recovery of your refund. The IRS generally has 10 years from the date of assessment to collect on a balance due.

Yet more would likely be due to the IRS at tax time. The IRS has a 10-year statute of limitations during which they. The Internal Revenue Service has a 10-year statute of limitations on tax collection.

That statute runs from the date of the assessment. Tax bills of more than 50000 take 7-12 months. As a general rule there is a ten year statute of limitations on IRS collections.

Banks are allowed up to 90 days from the date of the initial trace input to respond to. Once that time expires you are free from the remaining unpaid tax debt and the IRS cannot collect from you unless they go to court and create a tax judgement which is rare. After that the debt is wiped clean from its books and the IRS writes it off.

OICs must be finalized within 2 years after the IRS receives the OIC. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. There is an IRS statute of limitations on collecting taxes.

This tax is collected on estates that were created before January.

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

How Far Back Can The Irs Audit Your Tax Returns

How Far Back Can The Irs Go For Unfiled Taxes Abajian Law

Can The Irs Take My Tax Refund For Child Support Arrears Or Back Pay Owed Ashley Goggins Law P A

Here S Why Your Tax Return May Be Flagged By The Irs

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

:max_bytes(150000):strip_icc()/GettyImages-1252881116-35d3d55804a347deb0d97af3b9c6993e.jpg)

Irs Statutes Of Limitations For Tax Refunds Audits And Collections

How Long Does The Irs Have To Collect Back Taxes Brinen Associates

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Compliance Presence Internal Revenue Service

Do I Have Tax Refund Money From 2017 Irs Sitting On 1 3 Billion 10tv Com

Tax Levy Understanding The Tax Levy A 15 Minute Guide

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How Long Does It Take To Get A Tax Refund Smartasset

Know What To Expect During The Irs Collections Process Debt Com

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

2020 Guide To Getting Free Help Filing Paying Irs Back Taxes Forget Tax Debt

Back Taxes Legal Ways To End Your Problems With The Irs Debt Com